India’s 2026 Budget Essentials: GST Changes, ESG Rules & Tax Breaks

India’s Union Budget for 2026-27, announced by Finance Minister Nirmala Sitharaman on February 1, 2026, focuses on steady growth, job creation, and sustainable progress. It aligns with the goal of a developed India by 2047. CA firms in Mumbai and other cities can use this to guide clients through GST updates, ESG requirements, and tax savings. This post offers clear steps for businesses to adapt quickly.

Mumbai-based CA and CS firms can help businesses interpret Budget 2026 changes and ensure timely GST, ESG, and tax compliance.

Union Budget 2026 Highlights for Mumbai Businesses

India’s Budget 2026 focuses on fiscal discipline, infrastructure growth, tax relief, and ease of doing business. Higher capital spending, simplified compliance, and income tax benefits aim to boost investments, manufacturing, and long-term economic growth.

- Fiscal discipline: Fiscal deficit capped at 4.4% of GDP, reflecting controlled government spending.

- Infrastructure boost: ₹12.2 lakh crore allocated for roads, railways, ports, and logistics development.

- Tax relief: Individuals enjoy tax-free income up to ₹12 lakh under revised tax slabs.

- Business ease: Reduced compliance and red tape to support businesses and attract investments.

- Growth target: Budget targets 7.5% economic growth through reforms and higher capital expenditure.

GST Changes in Budget 2026 for Mumbai Businesses

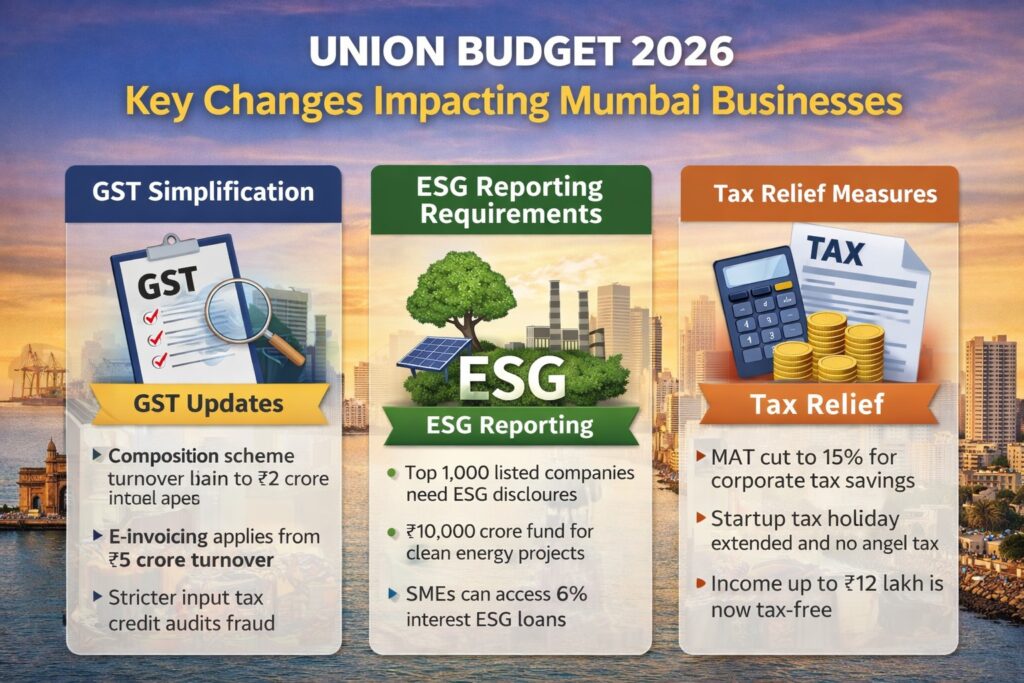

GST rules got user-friendly tweaks. Businesses with turnover up to ₹2 crore in most states qualify for the composition scheme, meaning fewer returns and simpler filings. E-invoicing now starts at ₹5 crore turnover threshold, reducing errors and speeding up refunds.

TCS on overseas education and travel drops to 5%, helping families and startups manage cash better. Stricter checks on input tax credits target fake invoices via automated systems. Exporters see faster processing for zero-rated supplies.

Action tip: Switch to auto-populated GSTR forms. Prepare for audits in sectors like real estate. Maintain digital records for quick compliance.

ESG Reporting Basics

ESG covers Environment, Social, and Governance practices. From FY 2026-27, top 1,000 listed companies must disclose data on emissions, water use, employee welfare, and ethical boards. A ₹10,000 crore Green Fund backs solar, EVs, and clean tech. SMEs access 6% interest loans for upgrades. Non-followers face fines up to 2% of revenue.

For Mumbai industries like shipping and textiles, track Scope 1-3 emissions first with basic tools. Report workforce diversity (target 30% women) and anti-corruption steps. Banks prioritize ESG in loan approvals, giving compliant firms an edge.

Final applicability depends on government notifications and circulars issued after the Budget.

Tax Relief Measures

Corporate Minimum Alternate Tax (MAT) lowers to 15%, saving companies billions annually. Startups extend their three-year tax holiday. Angel tax on investments ends completely.

Personal taxes improve: 5% slab from ₹3-6 lakh, standard deduction to ₹75,000, and extra rebates for seniors. Crypto gains stay at 30% tax, but TDS cuts to 0.1%.

Shift focus from disputes to planning. File ITRs by July 31 using pre-filled data and matching tools.

Practical Steps for Mumbai Businesses

Mumbai businesses face faster compliance due to high GST collections and growing ESG focus. Ports, factories, and service companies must act quickly to manage GST changes, ESG reporting, and tax updates without increasing costs or risks.

- Assess turnover: Check annual turnover to see if composition scheme eligibility applies under updated GST rules.

- Collect ESG data: Gather energy bills, employee records, and safety data needed for ESG disclosures.

- Update ledgers: Modify accounting records to reflect new tax deductions and compliance changes.

- Upskill teams: Enroll staff in free online skill courses for GST, ESG, and compliance awareness.

- Use software: Adopt affordable compliance software for tracking GST returns and ESG data efficiently.

- Seek local support: Engage Mumbai-based CA or CS firms offering bundled services at reasonable costs.

Early action helps Mumbai businesses stay compliant, reduce risks, and save long-term costs.

Overcoming Common Challenges

Mumbai businesses often face high ESG setup costs of ₹5–10 lakh, though government grants can cover up to 50%. Automated GST alerts may flag genuine claims, so keeping proper backups is essential. CA and CS firms can offer Budget Compliance Packs starting at ₹50,000, highlighting returns like faster refunds and smoother compliance. Businesses should also monitor expected interest rate cuts to reduce borrowing costs.

Why Act Today

This budget blends expansion with responsibility. GST simplifies routines, ESG attracts investors, and tax relief drives spending. Mumbai CAs gain from rising demand for advice.

Businesses should consult a Mumbai-based CA or CS to assess Budget 2026 impact and compliance timelines.

Visit official budget sites for forms. Deadlines hit April 2026—start now for smooth sailing.

F.A.Q.

Budget 2026 impacts Mumbai businesses through simplified GST compliance, higher ESG reporting focus, and tax relief measures. Sectors like manufacturing, ports, services, and startups must adapt quickly due to stricter digital monitoring and faster compliance timelines.

No. GST changes apply based on turnover, sector, and registration type. Small businesses may benefit from the composition scheme, while larger firms must follow updated e-invoicing, return filing, and stricter input tax credit verification rules.

The top 1,000 listed companies must comply with mandatory ESG reporting from FY 2026–27. Other large companies and MSMEs may face indirect ESG requirements from banks, investors, and regulators while applying for funding.

Startups benefit from an extended tax holiday, removal of angel tax, and easier funding norms. MSMEs gain from simplified compliance, access to lower-interest loans, and deductions aimed at encouraging investment and job creation.

CA and CS firms help businesses interpret Budget changes, update GST and tax compliance, prepare ESG reports, manage filings, and reduce risks. Mumbai-based firms also offer ongoing advisory to ensure timely compliance and tax efficiency.